can you ever owe money on stocks

Read on to learn the circumstances. Situations Where You Can Lose More Than You Invested.

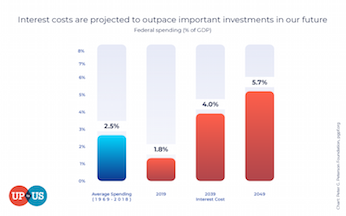

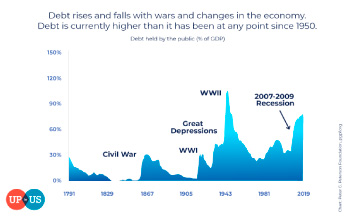

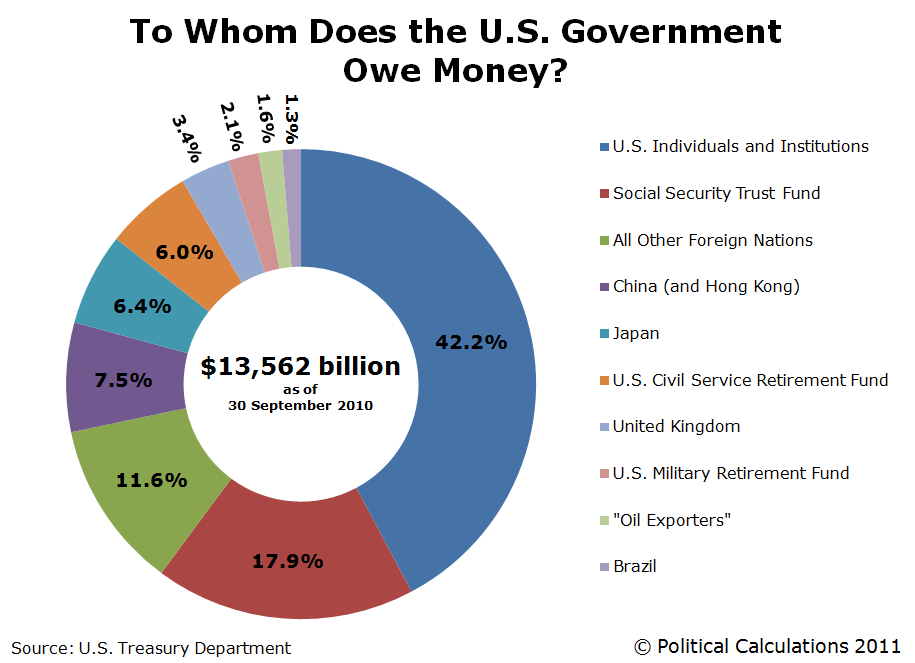

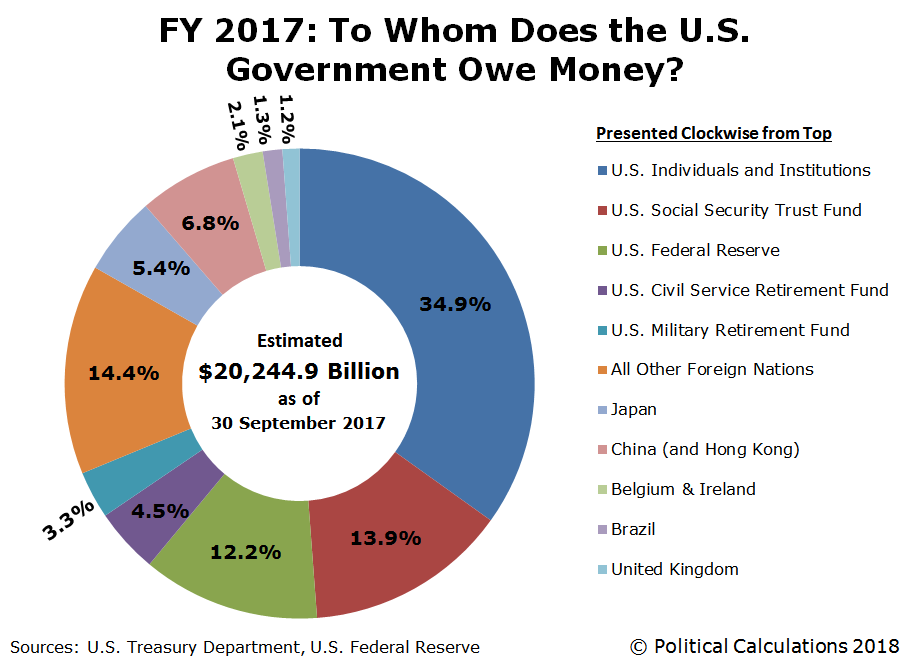

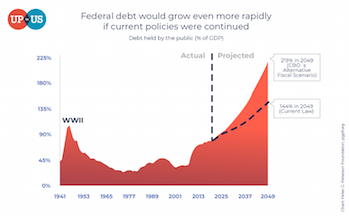

Who Does The Us Owe Money To 2020 Update I Up To Us

You can lose money this way with every type of investment known.

. Many businesses pay their. Yes a company can lose all its value and have that be reflected in its stock price. You wont lose more money than you invest even if you only invest in one company and it goes bankrupt and stops trading.

How Much Can You Lose. However this is rare. However while this cannot happen the book value can go negative and you can lose more money than you invested or end up in debt.

However there are two specific situations where you lose more than the amount of money you. You might end up trying to lock in a trade that looks like a real winner the moment you hit execute and slippage can come in wipe that trade out completely and instead lock you into a trade that has you owing money to your broker. Margin borrowing available at most brokerages allows investors to borrow money to buy stock.

Technically yes but practically no. I didnt know this back then but it looks like I owe income taxes on. Even if you borrow to buy shares or funds or whatever youll get a margin call and automatic closeout liquidation of your position before you go negative.

The simplest tax errors--including errors of omission--can be the most costly. Buy on Margin Face Margin Call. The purchased stock is collateral for the loan.

When a person buys a security on margin a broker is lending money to purchase securities beyond what the individual has available in his or her account. You cannot have negative money in stocks because even if the price of your stocks fluctuates or falls drastically it cannot attain a value less than zero. If however the stock price went.

While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. A company can lose all its value. Selling Stocks on a Margin.

This positions you to benefit from the approximate 10 average annual returns of the stock market as easily and cheaply as possible. This can happen when a stock is declining in value as well as when it is appreciating in value. This is the most basic way that you can lose money in the stock market.

Let me simplify this for you even more--get to a trusted tax pro who can handle this for you while you run your business. Even though the value of a stock can never go below zero it is possible to lose more than what you invested in the stock market and end up with a debt. You can lose all your money in stocks or any other investment that has some degree of risk.

At least you SHOULD with any decent broker. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. Major indexes like the New York Stock Exchange will actually de-list stocks that drop below a certain price It can even file for bankruptcy.

Shareholders can lose their entire investment in such unfortunate situations. However you may not receive all of your money back ifwhen you sell. If your stocks bonds mutual funds ETFs or other securities lose value you wont normally owe money to your brokerage.

An exception to these required minimum distributions or RMDs is. If the stocks price dropped to 0 you would owe the lender nothing and your profit would be 5000 or 100. Stocks bonds mutual funds ETFs options futures even art and collectibles.

There are specific instances where a person can be in debt from stock purchases. Although a common issue slippage can cause you to owe money to your broker depending on how heavily leveraged you are. The difference between the price you buy and the price you sell.

Answer 1 of 3. It really depends on whether youre buying stocks on a margin loan or with cash. Major indexes like the New York Stock Exchange will actually de-list stocks that drop below a certain price It can even file for bankruptcy.

A shady one might not liquidate or might liquidate early or never put on your trade in the first place. Losing money in the stock market happens quite often. If youre using your own money to invest in shares without using any advanced techniques to trade then the answer is no.

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

How To Collect Money From People Who Owe You

/voluntary-repossession-lower-cost-less-chaos-315104_color-284d0e3497ff44cdb954769db22b839b.png)

Voluntary Repossession Lower Cost Less Chaos

Do You Have Unclaimed Property Money Saving Strategies Personal Financial Planning Unclaimed Money

Can A Stock Price Be Zero Or Negative Quora

Can You Lose More Money Than You Invest Wealthify Com

What Happens If I Buy A Stock And It Goes Down

I Owe Robinhood 30 000 The Real Risks Of Day Trading Youtube

I Owe Robinhood 4k And Have For Months Wonder What They Ll Do R Wallstreetbets

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

Who Does The Us Owe Money To 2020 Update I Up To Us

Who Owns The U S National Debt Seeking Alpha

Investors Listen Up In This Video We Break Down What Stock Buybacks Are And How They Can Make You Money Owe Money Shares Outstanding Make It Yourself

To Whom Does The U S Government Owe Money Seeking Alpha

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Will I Owe Money On Robinhood If I Let My Buy Call And Buy Put Options Expire Quora

Who Does The Us Owe Money To 2020 Update I Up To Us

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz